the tax shelter aspect of a real estate syndicate

Invest in more real estate. However the broader definition of small business is a surprise to many.

Real Estate Syndication How It Works And How To Participate

Your CPA or Tax advisor is the best person to.

. Field has become very large and many instances of fraud are coming. In New York Article 23-A of the New York General Business Law GBL commonly referred to as the Martin Act gives the Attorney General the authority to enforce its provisions which regulate. Resolving Problems Raised by the 1969 Act 29 NYU.

These gains are taxed at a rate of 15 with certain exceptions. It introduces the concept of a syndicate as a tax shelter. Any depreciation that was deducted on the property would be subject to tax rates not to exceed 25.

Reform of Real Estate Tax Shelters 7 U. The tax shelter aspect of real estate syndicates no longer exists. Is considered a syndicate and thus a tax shelter in year 1 for purposes of Sec.

In short the tax shelter aspect of real estate syndicates no longer exists. Mutual fund whose shares are issued and redeemed by the investment company at the request of. 20 capital gains tax.

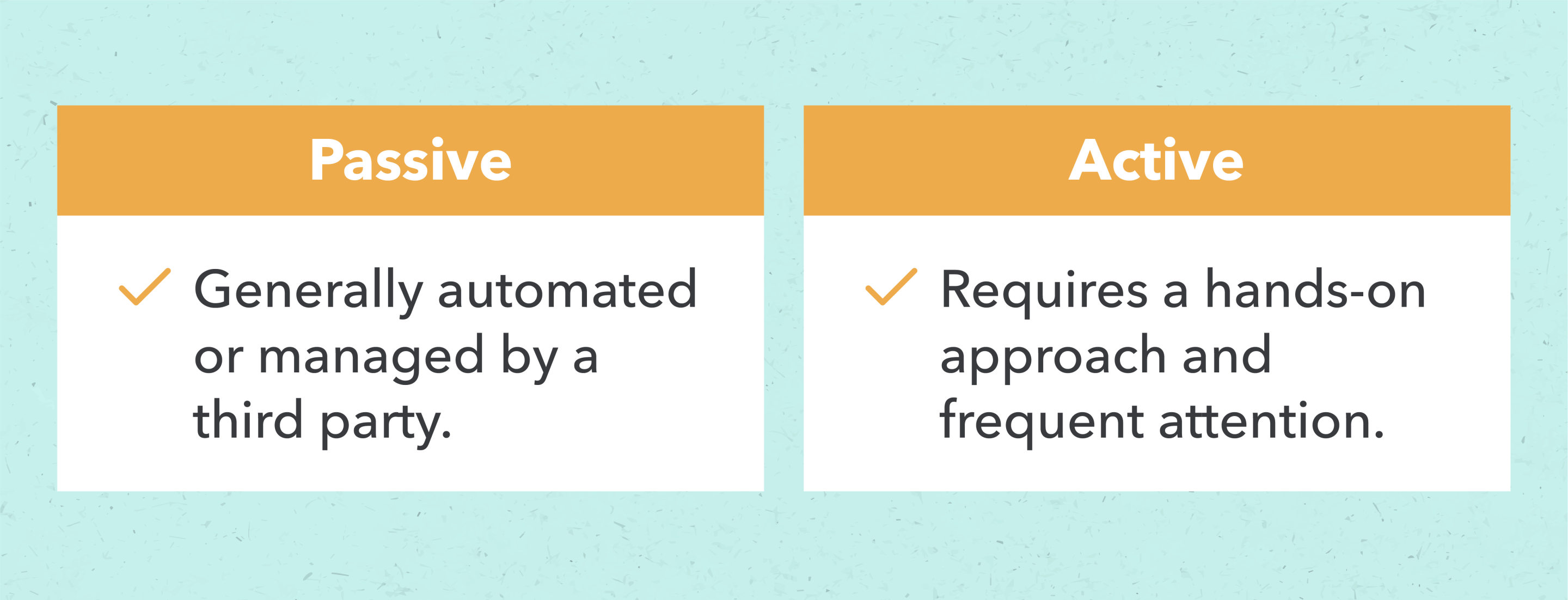

Subchapter B - REAL ESTATE SYNDICATES. Passive Real Estate Investors. Capital gains taxes even at 20 are lower taxes on earned income.

Taxation Rates of Capital Gains are Lower. They have passive activity gains and need a shelter. Tion on Real Estate and its Recapture.

461 because more than 35 of the loss will be allocated to B who is considered a limited. The syndication members will receive pro rata shares of that gain and theyll need to pay a combination of depreciation recapture and capital gains tax on their respective shares. Subchapter B - REAL ESTATE SYNDICATES.

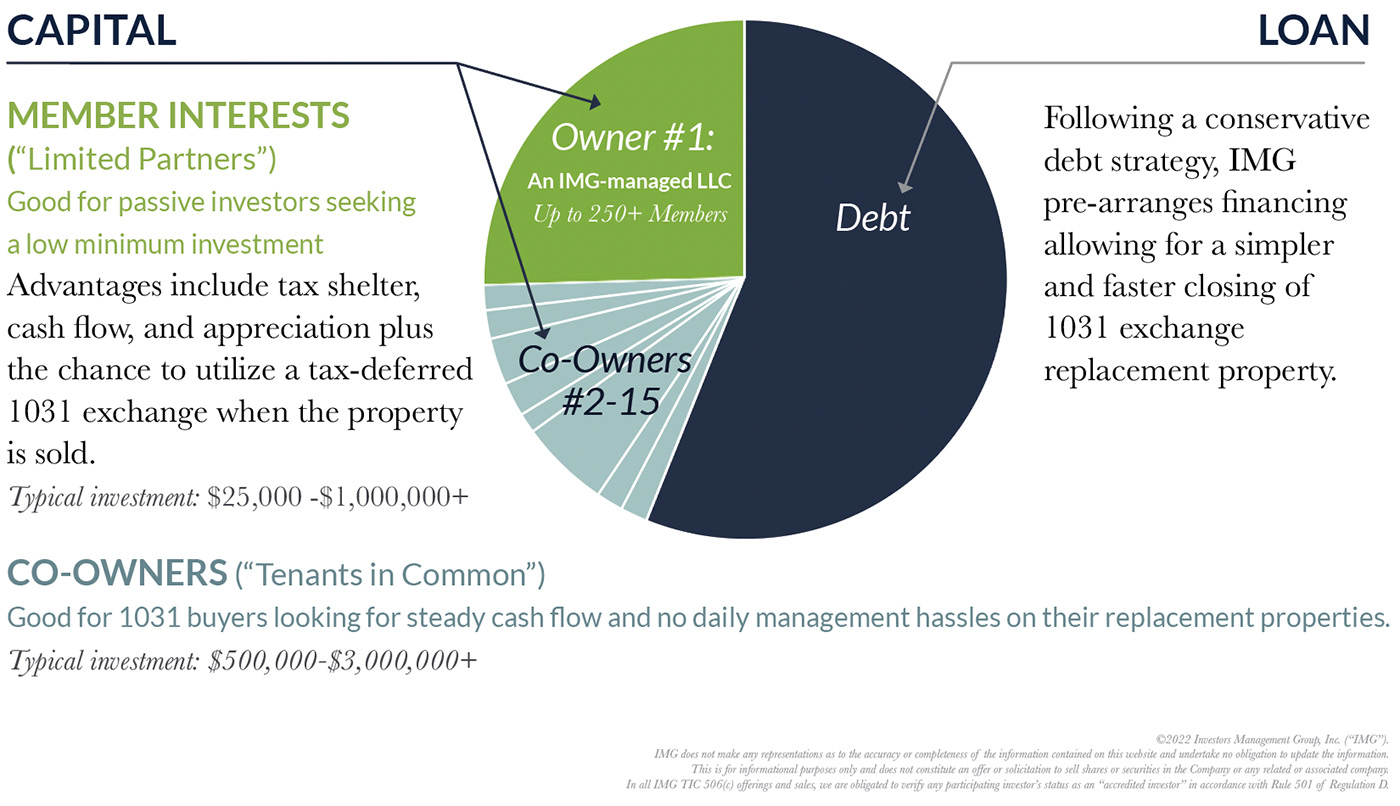

Long-term investments such as. Here are the 11 tax benefits of real estate syndications for Limited Partner LP investors. Compare Part 16 - REAL ESTATE SYNDICATION OFFERINGS 161 to 1612.

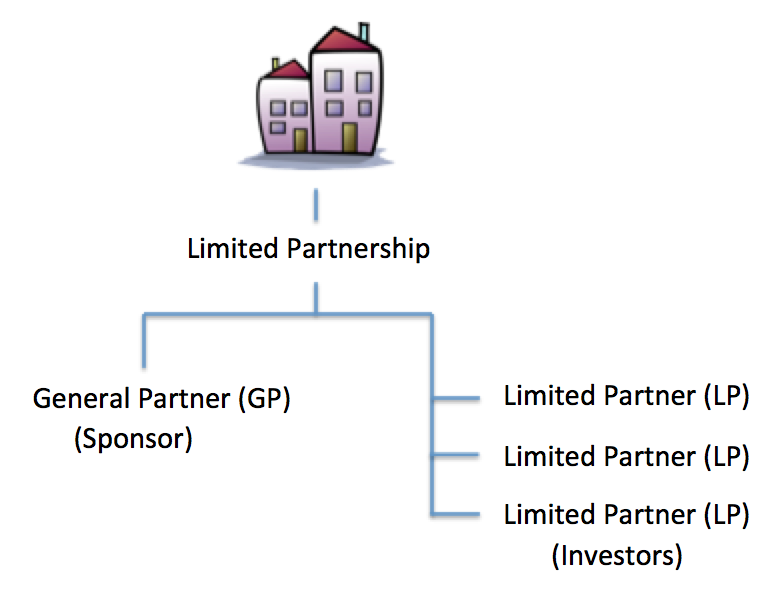

If you have a full time job that wont afford you the opportunity to build your own empire of tax efficient real. In this article well. A syndicate is defined as a partnership or other entity.

The tax shelter aspect of a real estate syndicate. Try very very hard to avoid divorce. So heres the good news.

Article on real estate syndicates says many investors have suffered losses while trying to gain tax shelters. Today real estate investors must use accelerated depreciation methods to recover thecosts. Tax Benefits of Investing in Real Estate Syndication.

Currently you are required to use which method of depreciation in real estate investments. These examples of tax shelters apply to real estate but there are others including tax-deferred retirement accounts 401ks and tax-sheltered annuities 403b. Many people look to Real Estate Syndication for tax purposes.

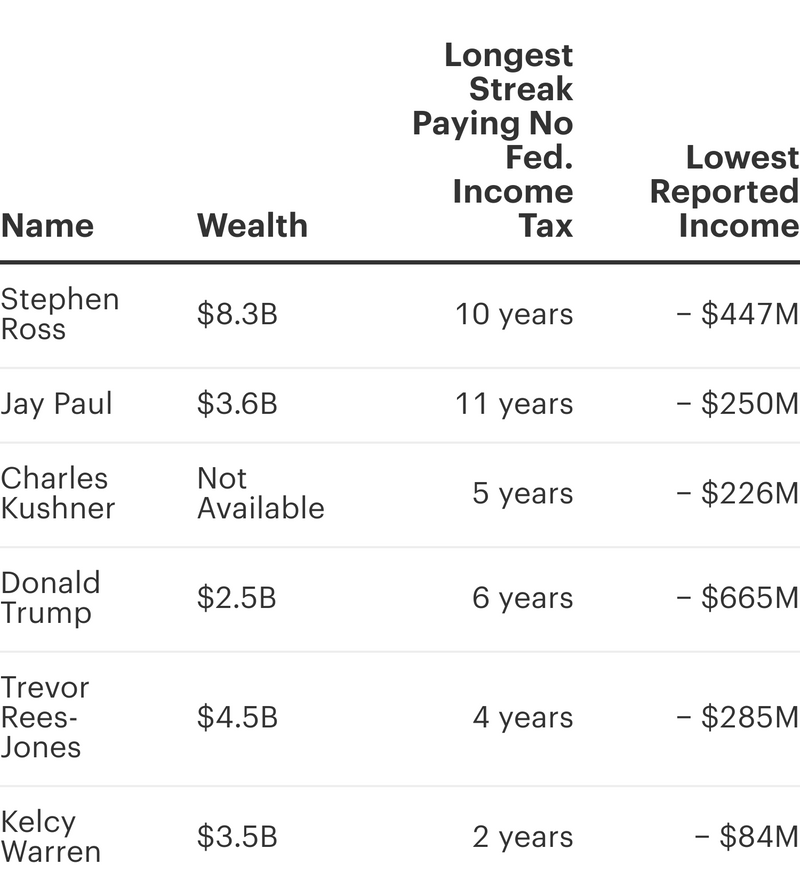

When You Re A Billionaire Your Hobbies Can Slash Your Tax Bill Propublica

Real Estate Syndication Tax Benefits For Investors Fnrp

These Real Estate And Oil Tycoons Avoided Paying Taxes For Years Propublica

Cash Flow Appreciation Or Tax Shelter What Are Your Goals For Investing In Real Estate Syndications Smart Capital Llc

6 Tax Benefits Of Investing In Real Estate Syndications

Real Estate Syndication Vs Reit

What Is Real Estate Syndication Abcs Of Real Estate Syndication Investments For A Physician Investor

The Guide To Real Estate Syndications Part I White Coat Investor

New Shakeout In Real Estate Syndicates The New York Times

Real Estate Syndication For A Physician Investor Physicianestate

The Complete Guide To Real Estate Syndications For Passive Investors

Passive Real Estate Investing Earn Passive Income Intuit Mint

A Primer On Real Estate Professional Status For Doctors Semi Retired Md

Our Investment Strategy Investors Management Group Inc

Real Estate Syndication 3 Ways To Accelerate Growth Accidental Rental

Real Estate Investors And Taxes Goodegg Investments

A Peek Into The Projected Returns In A Real Estate Syndication